Philippine Stock Report #16: Universal Robina Corporation (URC)

Hi Everyone!

We'll discuss Universal Robina Corporation (URC) as one of the companies that dominate the Food, Beverage & Tobacco industry. URC is one of the largest branded consumer food and beverage product companies in the Philippines. It is among the Philippines' pioneers in the industry. This company has been in the industry for more than 50 years and yet they continuously expand their wide variety of products that cater Asia,Europe, Japan, Korea, Middle East, Ghana, Nigeria, New Zealand and Australia.

The Company is involved in a range of food-related businesses, includiing the manufacture and distribution of branded consumer foods; production of hogs and poultry; manufacture of animal feeds and veterinary products; flour milling; and sugar milling and refining. URC also ventured in the renewables business for sustainability through distillery and cogeneration divisions.

San Miguel Corporation was a big customer of URC.

1. Basic Information:

Universal Robina Corporation

Sector: Food, Beverage & Tobacco

2. Company's HIstory:

1952: Mr. John put up his first company, Amasia Trading that imports basic food commodities from U.S.

1954: Universal Corn Products, Inc. was incorporated.

1959: Consolidated Foods Corporation (CFC) was incorporated.

1966: Universal Robina Corporation was established.

1970: Robina Farms entered into the hogs business. Universal Corn Products, Inc. was renamed as Universal Robina.

1971: URC Hong Kong was established.

1987: URSUMCO was incorporated.

1988: URC entered sugar milling business through URSUMCO and SONEDCO.

1989: URC Singapore was incorporated.

1990: URC entered into a plastic business through URC Packaging business. URC acquired CARSUMCO.

1992: URC Thailand, one of URC's largest foreign subsidiaries was incorporated.

1994: Universal Robina Corporation becam a publicly listed company. Nissin Universal Robina Corporation, a joint venture between URC and Nissin Food Products Co. Ltd. was incorporated.

2002: URC Indonesia was incorporated.

2003: URC Vietnam was incorporated.

2013: URC factory in Myanmar was incorporated.

2014: URC has entered into a new joint venture agreement with Calbee, Inc. URC also acquired Griffin's Food Limited, the largest snacks and biscuits company in New Zealand.

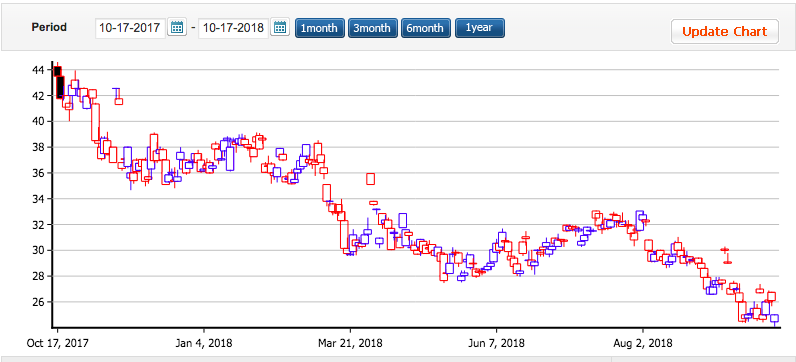

<Here's the Company's Stock Data for the past year 2017-2018>

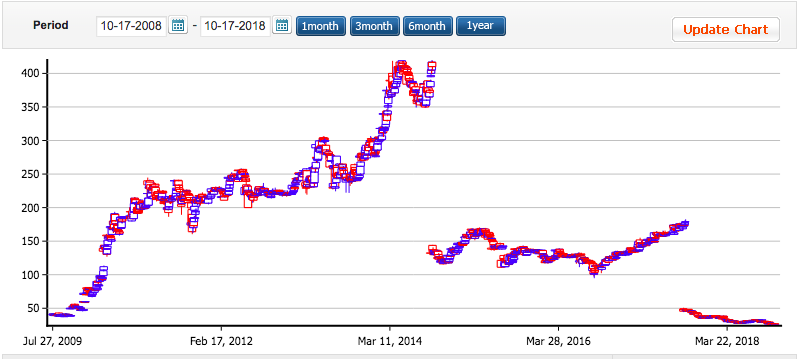

<The Company's Stock Data for the past 10 years 2008-2018>

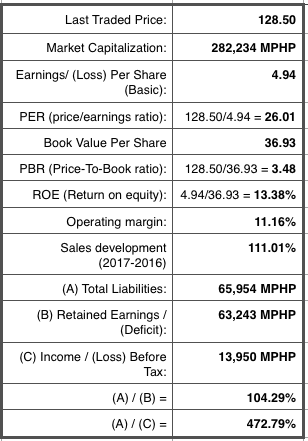

3. Present Stock (December 20, 2018)

4. Chairman of the Board

Chairman Emeritus: John L. Gokongwei, Jr.

Age: 92

Nationality: Filipino-Chinese

Education: Primary and High School at University of San Carlos; Masters of Business Administration at De La Salle University

Net Worth: $4.4 billion

Background:

- Founder and Chairman of JG Summit Holdings, Inc.

- Founder and Chairman Emeritus of Universal Robina Corporation

- Founder and Chairman Emeritus of Robinsons Land Corporation

- Director of Robinsons Retails Holdings, Inc.

- Director of A. Soriano Corporation

- Executive Director of Oriental Petroleum and Minerals Corporation

- Non-Executive Director of Cebu Air, Inc.

- Non-Executive Deputy Chairman of Singapore Land Limited

- Non-Executive Director of Manila Electric Company

5. News

November 11, 2018

Universal Robina Corporation inks sustainable potato program with DA, donates quality seeds to co-op.

October 1, 2018

Universal Robina takes full control of Hunt-Universal Robina Corp.

【Poker】Short Deck (6+) Hold’emの基本情報まとめ。どう戦う?

2020/11/19追記

当ブログを執筆後にPokerstarsではストレート>3カードの役強さが採用されたため、この記事は意味をなさなくなってしまいました。お気をつけください

はい、お久しぶり、ナマスデー

Short Deck (6+) Hold’emについてまとまった情報がなかったので、ものぐさな方のために情報をまとめてみました。2014年頃にマカオを発祥のゲームで、最近はPhil Ivey や Tom Dwanといったトッププロも好んでプレーしているようです。大きなイベントのサイドイベントとして今後盛り上がっていくかも・・・ポカスタが準備中という噂もあります。

■基本ルール

通常のテキサスホールは52枚のカードを使いますが、ショートデッキホールデムは2~5までの16枚のカードを使いません。ゆえに6以上のカードしか使わないのでシックスプラス(6+)ホールデムと表現されることもあります。以降は覚えやすいので6+ホールデムと表現します。

出現確率の違いからポーカー役の強さが下記のように変わります。

※A6789はストレートとなります。

※場所によってはフルハウス>フラッシュというローカルルールもあるので注意

■基本勝率・確率など

(1)ハンドの強さランキングはどう変化するか?

こちらが普通のホールデムのランダムハンドに対する勝率です。

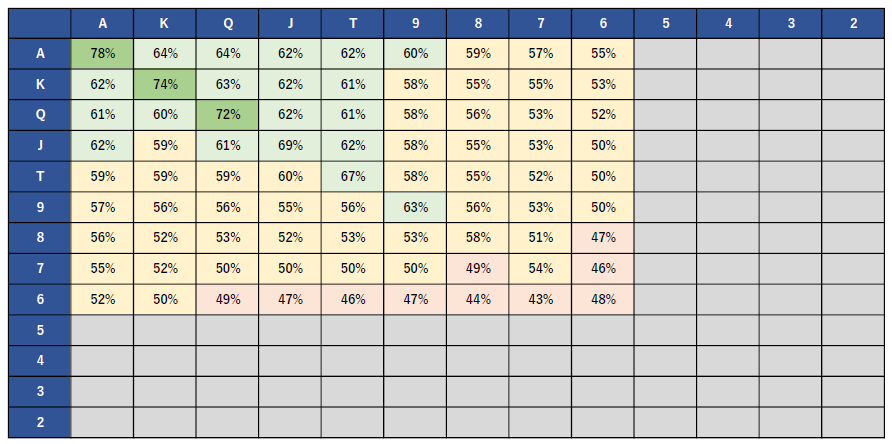

そしてこれが6+ホールデムの勝率です。

参照:Americas Cardroom - Six Plus Holdem

参照:Americas Cardroom - Six Plus Holdem

・全体的にホールデムに比べ数字がまるくなっていることがわかります。

・ブロードウェイカードのポケット・コネクターは強く、差が少ない。

・スーテッドかどうかはそこまで差が出ない。

・こちらの表はタイの%も含んでいます。ポケットはタイになることが少ないので、表の数字より若干強めに見積もった方がいいと思われます。

(2)プレミアハンドの出現率

全体的にプレミアハンドが倍の頻度できます。

同じ割合でスーツが少なくなるのでスーテッドカードはほぼ同じです。

(3)代表的なぶつかり合い

AA vs KK

AKo vs JTo

JTo vs 66

KQo vs JTo

参照:Hold'em Calculator for short and full deck

(4)代表的なドローやセットの確率等

(5)アウツとそれの出現確率

通常のホールデムはアウツ×2%でターンでそれが引ける確率、アウツ×4%でリバーまででそれが引ける確率が概算で計算できます。いわいるこの2-4の法則が6+ホールデムでは3-6の法則になります。詳しくは下記の表を参照。

■チップスや戦略など

◎フラッシュドローはアウツが9枚から5枚になります。一方で、ストレートドローのアウツ8枚なのでドローを引ける確率が違う。

→リバーまでに引ける確率はフラッシュドローが30%、OEストレートドローが48%

◎セットはストレートより役が強いので、フロップセットに対してOEストレートドローはドローイングデッドになるので注意。

◎Tがストレートの要であり、JTやT9は使いやすく、AK vs JTの勝率はほぼ同じ。

◎ポケットはフロップセットができやすく、AAも他のポケットにクラックされやすい。

◎役の出現頻度が全体的に上がるので、TPTKはそんなに強くない。

◎強いハンドもたくさん来るし、役もできやすいのでオーバープレー注意

◎弱いキッカーに気を付ける。 ホールデムのA8oは6+ホールデムのAToくらい

===

以上、散らばっている情報をざっくりまとめました。

上記の事実からどんなフィールドになって、どんな戦い方を選択するのかはまだまだ未開拓だし、議論する余地がはてしなくあると思います。そもそも英語の情報ソースもまだまだ少ないです。6+ホールデム童貞の田中はここ数日妄想を膨らませて、妄想戦略を練っております。

以下、妄想。

◎ホールデムの延長でKK+をオーバープレーしちゃう人はすごく多くなる。なので3betに対してポケットやJTsで積極的に参戦することは面白いかも。

◎フラッシュはできずらいけど、フルハウスより強いということは強力なドローになる。ストレートドローが多くいるマルチの状況は多々発生すると思われるので、ここでフラッシュドロー付きのストレートドローでアグレッションを発揮して、ほかのドローにイクイティを捨てさせることはかなり利益的だと思われる。

◎ドローヘビーなボードでセットはかなり強力な手になるものの、SOSの出現率も上がっているので、ローセットはケア必要。

◎ツーペアは24%の確率でリバーまでにフルハウスに昇格するので、ストレート濃いめなボードでもコールをちゃんと検討するべき。

◎感覚的にホールデムとオマハの中間くらいのバランス感覚で挑むべきかな。

いろいろガチャガチャ考えてみるのは面白いですが、実際にやってみたいですよね。

あるんです! 来週から! わーい

■2018年11月28日以降 毎週水曜日15:00~ @OKADA manila

PokerStars LIVE Manila - Weekly Live Poker Tournaments

■2018年11月30日 14:00 @APT (resorts world manila)

https://www.theasianpokertour.com/apt-events/apt-finale-philippines-2018

はい、現地でお会いしましょー

【参照サイト一覧】

https://www.pokerlistings.com/short-deck-holdem

https://www.vip-grinders.com/short-deck-poker-how-it-works/

https://worldpokerdeals.com/blog/where-and-how-to-play-short-deck-six-plus-hold-em

https://www.cardplayer.com/cardplayer-poker-magazines/66386-cppt-heads-to-texas-31-14/articles/23416-short-deck-math

https://pokerfuse.com/online-poker-in/guides/210134-six-plus-holdemshort-deck-poker-odds-and-probabilities/

https://www.pokervip.com/strategy-articles/6-hold-em/six-plus-hold-em-pot-odds-1

Philippine Stock Report #15: AgriNurture, Inc. (ANI)

Hi Everyone!

For the past few blogs, we've been discussing about companies from Mining and Oil Industry so for this blog we'll discuss about a company from Food, Beverage & Tobacco Industry, AgriNurture, Inc. (ANI) or formerly known as Mabuhay 2000 Enterprises, Inc.

ANI eventually diversified into various agro-commercial businesses and has become one of the country's top fresh mango exporters to the world markets.

At present, ANI also supplies other home-grown vegetables and fruits such as banana and pineapple to customers in Hong Kong, Mainland China, Japan, Korea, the Middle East, North America, Australia and to the different European regions.

ANI currently has satellite offices in Australia, Spain and the Netherlands.

The top dollar earner of ANI is by exporting all kinds of fruits, vegetables and other agro products with fresh banana, fresh mango and coconut water as its main export products.

The Company is also the first agricultural company to be listed in the Philippine Stocks Exchange (PSE)

1. Basic Information:

AgriNurture, Inc.

Sector: Food, Beverage & Tobacco

2. Company's History:

February 4, 1997: AgriNurture, Inc. (ANI) was incorporated and started its business operations in the same year as an importer, trade and fabricator of post-harvest agricultural machineries intended to improve the productivity as wellas increase the income of Filipino farmers.

May 25, 2009: Listing date of AgriNurture, Inc. to PSE

August 2011: ANI established its Retail & Franchising Group. The direct and indirect subsidiaries of the Company under the Retail Group are The Big Chill Inc., Heppy Corp., Goods and Nutrition for All (GANA).

August 8, 2011: the SEC approved the amendment of the Articles of Incorporation of the Company to, among others, including the business of retail in the primary purposes.

1st quarter of 2015: ANI ventured into the importation and trading of rice.

<Here's the Company's Stock Data for the past year 2017-2018>

<The Company's Stock Data for the past nine years 2009-2018>

3. Present Stock (2018/11/20)

4. Chairman of the Board

Chairman: Antonio L. Tiu

Age: 42

Natioality: Chinese-Filipino

Education:

- BS Commerce major in Management from De La Salle University, Manila

- Masters degree in Commerce specializing in International Finance from the University of New South Wales in Sydney, Australia

- Doctorate degree in Public Administration from University of the Philippines

Background:

- Chairman, CEO and President of AgriNurture, Inc since June 1, 2015

- CEO and President of Greenergy Holdings Incorporated

- Chairman and President of First Class Agriculture Corporation

- Chairman and President of Earthright Holdings Inc.

- President and CEO of Sunchamp Real Estate Development Co.

AGRINURTURE, INC. OWNERSHIP STRUCTURE

CORPORATE STRUCTURE

COMPANY SHAREHOLDING STRUCTURE

5. News

August 17, 2018

AgriNurture Inc. gains competitive edge in rice supply bid

June 15, 2018

AgriNurture investing P100-million in bank unit

Philippine Stock Report #14: Oriental Peninsula Resources Group, Inc. (ORE)

Hi Everyone!

Today, we'll be paying attention to a particular company which has been in the Industry of Mining and Oil for the past 10 years as a holding company intended primarily to consolidate and operate companies that own nickel mining Tenements in the Philippines. This company is quite new in the Industry compared to other companies.

Oriental Peninsula Resources Group, Inc. (ORE) is focused on the mining operations of its sole subsidiary, Citinickel Mines and Development Corporation (CMDC), which is primarily engaged to prospects, explore, locate, acquire, hold, work, develop, lease, operate and exploit mineral lands for chromite, copper, manganese, magnesite, silver, gold and other mineral products.

ORE has a 99% equity interest in CMDC, which is the sole claim owner of the Pulot Mine and the Toronto Mine located in the province of Palawan, namely in the municipalities of Sofronio Espanola and Narra.

http://www.orientalpeninsula.com

1. Basic Information:

Oriental Peninsula Resources Group, Inc. (ORE)

Sector: Mining and Oil

2. The Company's History:

April 16, 2007: Oriental Peninsula Resources, Inc. (ORE) was incorporated as a holding company intended primarily to consolidate and operate companies that own mining tenements located within the Philippines

August 22, 2007: The Company filed a Registration Statement with the SEC for the registration of the Offer Shares and the issued and outstanding shares of the Company not coevered by the Offer in accordance with the provisions of the Securities Regulation Code.

August 23, 2007: The Company filed its application for the listing and trading of all of the Company's issued and outstanding sgares, inclusive of the Offer Shares, in the Philippine Stock Exchange (PSE)

November 28, 2007: The Board of Directors of the PSE approved the listing of the Common Shares

December 19, 2007: The Company's listing date

<Here's the Company's Stock Data for the past year 2017-2018>

<The Company's Stock Data for the past ten years 2008-2018>

3. Present Stock (2018/10/18)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Caroline L. Tanchay

Age: 45

Nationality: Filipino

Education: Bachelor of Science in Commerce major in Management from De La Salle University

Background:

- Chairman of the Board, President, Chief Executive Office of Oriental Peninsula Resources Group, Inc.

- President of Citimax Group, Inc., Rockworks Resources Corp., Rockworks, Inc., Citinicckel Mines and Development Corp., and Maxwell Heavy Equipment Corp.

- Director in Moreland Realty Corp.

5. News

August 26, 2018

Philippine Stock Exchange prevents ORE from listing private-placement shares

https://businessmirror.com.ph/pse-prevents-ore-from-listing-private-placement-shares/

June 27, 2018

Oriental Peninsula ventures into power

https://www.philstar.com/business/2018/06/27/1828122/oriental-peninsula-ventures-power

Philippine Stock Report #13: Semirara Mining and Power Corporation (SCC)

HI Everyone!

Today, we'll be discussing a company from the Mining & OIl Industry since the 1980s. Semirara Mining & Power Corporation (SCC) is the largest coal producer in the Philippines, and the only power producer in the country that owns and mines its own fuel source (coal).

SCC is engaged in thermal coal extraction and power production.

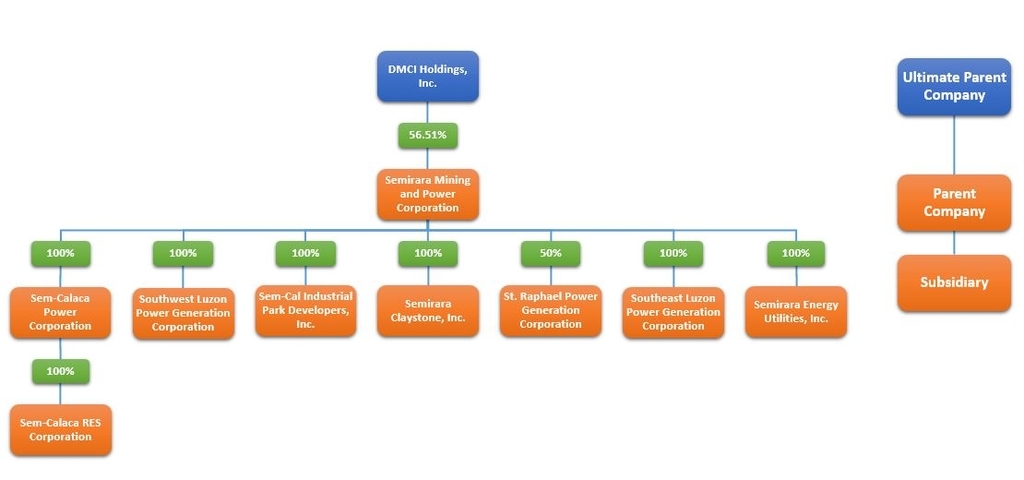

The Company is also a subsidiary of DMCI Holdings, Inc. DMCI Hi currently holds 56% ownership of SCC.

The Company generates its revenues through the production and sale of sub-bituminous coal. Currently, SCC has existing coal supply contracts with its own power subsidiaries as well as other power plants and cement manufacturers.

1. Basic Information:

Semirara Mining and Power Corporation (SCC)

Sector: Mining and Oil

2. The Company's History:

February 26, 1980: Semirara Mining and Power Corporation (SCC) was incorporated to explore, develop, and mine the coal resources in Semirara Island, Caluya, Antique Province.

November 28, 1983: The Company's listing date.

1988: The Company struggled through low productibity, operational inefficienciesm debt restructuring, falling coal prices, and the Philippine peso devaluation.

April 1997: DMCI Holdings, Inc. (DMCI HI) acquired a 40% interest in SCC's Common Shares, including PHP2.5 Billion of its outstanding loans.

1998: DMCI HI agreed to a debt-to-equity conversion and raising its total interest in SCC to 74%.

August 1999: DMCI appointed a new management team composed of local and expatriate stadd. Soon After, it changed its name to Semirara Mining Corporation.

2009: DMCI HI acquired the 600 MW coal-fired power plants from the NPC and assigned its rights over the plant to SCC, turning the company into the only vertically integrated power generation enterprise in the country.

August 18, 2014: Semirara Mining Corporation changed its name to the Semirara Mining and Power Corporation after successfully bidding for the 600 megawatt Calaca power plant of the National Power Corporation (NPC).

December 31, 2017: SCC has six wholly-owned subsidiaries, namely, SEM-Calaca Power Corporation; SEM-Cal Industrial Park Developers Inc.; Southwest Luzon Power Generation Corporation; Semirara Claystone Inc.; Semirara Energy Utilities Inc.; and Southeast Luzon Power Generation Corporation.

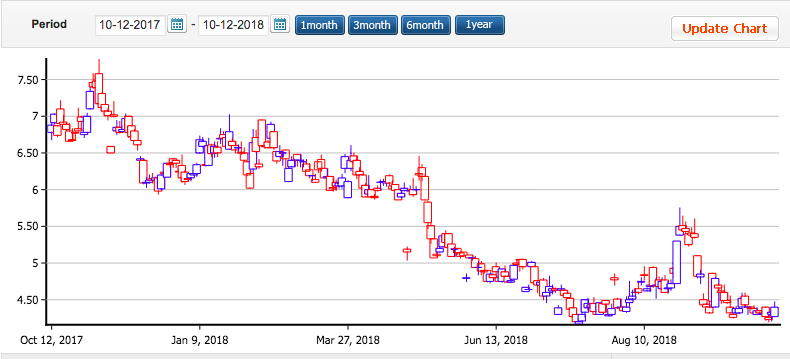

<Here's the Company's Stock Data for the past year 2017-2018>

<The Company's Stock Data since 2008 to 2018>

3. Present Stock (2018/10/17)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Peso (PHP)

4. Chairman of the Board

Chairman: Isidro A. Consunji

Nationality: Filipino

Age: 69

Education:

- Bachelor of Science in Civil Engineering from University of the Philippines

- Master's Degree in Business Economics from Center for Research & Communication

- Business Management from Asian Institute of Management

- Advanced Management from IESE School, Barcelona, Spain.

Background:

- Executive Director, Chairman and President of DMCI Holdings, Inc.

- Non-Executive Director of Crown Equities, Inc.

- Non-Executive Director of Atlas Consolidated Mining and Development Corp.

- Chairman & CEO of SEM-Calaca Power Corporation, Semirara Claystone Inc., Semirara Energy Utilities Inc., SEM-Balayan Power Generation Corporation, Southwest Luzon Power Generation Corporation, SEM-Cal Industrial Park Developers Inc., and DMCI Mining Corporation

- Chariman of St. Raphael Power Generation Corporation, and ENK Plc (U.K.)

- Vice-Chairman of DMCI Masbate Power Corporation

- Director of Dacon Corporation, M&S Company Inc., DMCI Projects Dvelopers, Inc., Toledo Mining Corporation Plc (U.K.), Semirara Cement Corporation, Maynilad Water Services, Private Infra Dev. Corp., and SEM-Calaca Res Corporation

GROUP CORPORATE STRUCTURE

SEMIRARA MINING AND POWER CORPORATION AND SUBSIDIARIES

SHAREHOLDINGS STRUCTURE

5. News

April 6, 2018

26 PHL firms among Asia Pacific's fastest growing companies

http://www.semiraramining.com/news/content/News_Articles/117

Philippine Stock Report #12: Philex Mining Corporation (PX)

Hi Everyone!

Today, we'll be discussing a company from the Mining and Oil Industry since 1955 and has the oldest operating mines in the country. The Philex Mining Corporation (PX).

The Company and its subsidiaries are organized into two main business groupings: the mining business, which is directly under PX, Philex Gold Philippines, Inc. (PGPI) and Silangan Mindanao Mining Co., Inc. (SMMCI), and the energy and hydrocarbon business under PXP Energy Corporation (PXP), formerly Philex Petroleum Corporation.

The Company and its subsidiaries are primarily engaged in large-scale exploration, development, and utilization of mineral resources. PX operates the Padcal mine for the past 61 years using the underground block-cave method. It is one of the oldest operating mines in the country and produces copper concentrates, containing copper, gold and silver.

http://www.philexmining.com.ph

1. Basic Information:

Philex Mining Corporation (PX)

Sector: Mining and Oil

2. The Company's History:

July 19, 1955: Philex Mining Corporation (PX) was incorporated to primarily engage in mining activities.

November 23, 1956: The Company has been listed in the Philippine Stock Exchange.

February 29, 2016: The Company's Board of Directors approved a property dividend consisting of shares of stock of PXP at the ratio of seventeen PXP shares for every one hundred shares of PX

June 22, 2016: Securities and Exchange Commision approved the decision of the Company's Board of Directors last February 29, 2016

July 15, 2016: when PXP Energy Corporation (PXP) formerly Philex Petroleum Corporation, and its subsidiaries ceased to be subsidiaries of Philex Mining Corporation as a result of loss on control through property dividend declaration.

The transaction reduced PX's shareholdings in PXP from 64.7% to approximately 19.8%, allowing PX to leverage on its key strengths and focus its resources on its core business of metals mining, particularly with respect to the extension of Padcal's life of mine, commercoal operations of the Silangan project and development of other Company mining tenements.

December 31, 2016: The Group's mining business remains as its only business segment.

<Here's the Company's Data for the past year 2017-2018>

<The Company's Stock Data for the past 10 years 2008-2018>

3. Present Stock (2018/10/15)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Manuel V. Pangilinan

Age: 72

Nationality: Filipino

Education:

- Bachelor of Arts degree in Economics from Ateneo de Manila University

- Master of Business Administration degress from Wharton School of the University of Pennsylvania

Background:

- Founder of First Pacific Company Limited

- Chairman of PLDT Communications and Energy Ventures, Inc., Smart Communications, Inc., Metro Pacific Investments Corporation, Manila Electric Company, PXP Energy Corporation, Silangan Mindanao Mining Co., inc., Lando Pacific Corporation, Medical Doctors Inc., Cardinal Santos Medical Center, Asian Hospital, Inc., Davao Doctors, Inc., Riverside Medical Center Inc., Our Lady of Lourdes Hospital, Inc., Central Luzon Doctors' Hospital, Inc., Maynilad Water Services Corporation, Mediaquest, Inc., Associated Broadcasting Corporation (TV5) and Manila North Tollways Corporation.

- Chairman of the Manila Electric Company (MERALCO)

- Vice Chairman and Non-Executive Director of Roxas Holdings, Inc.

CORPORATE STRUCTURE OF FIRST PACIFIC COMPANY LIMITED

SHAREHOLDING STRUCTURE

5. News

August 3, 2018

Philex Mining profit drops in 2nd quarter

https://www.bworldonline.com/philex-mining-profit-drops-in-2nd-quarter/

May 10, 2018

Philex Mining net income drops on lower production

https://www.bworldonline.com/philex-mining-net-income-drops-on-lower-production/

Philippine Stock Report #11: Nickel Asia Corporation (NIKL)

Hi Everyone!

Today, we'll be starting to discuss about companies from Mining and Oil Industry. Starting from this report until to the next four reports, we'll understand on the current situation of stocks of these companies with the continous global oil price hike. We'll start with Nickel Asia Corporation (NIKL).

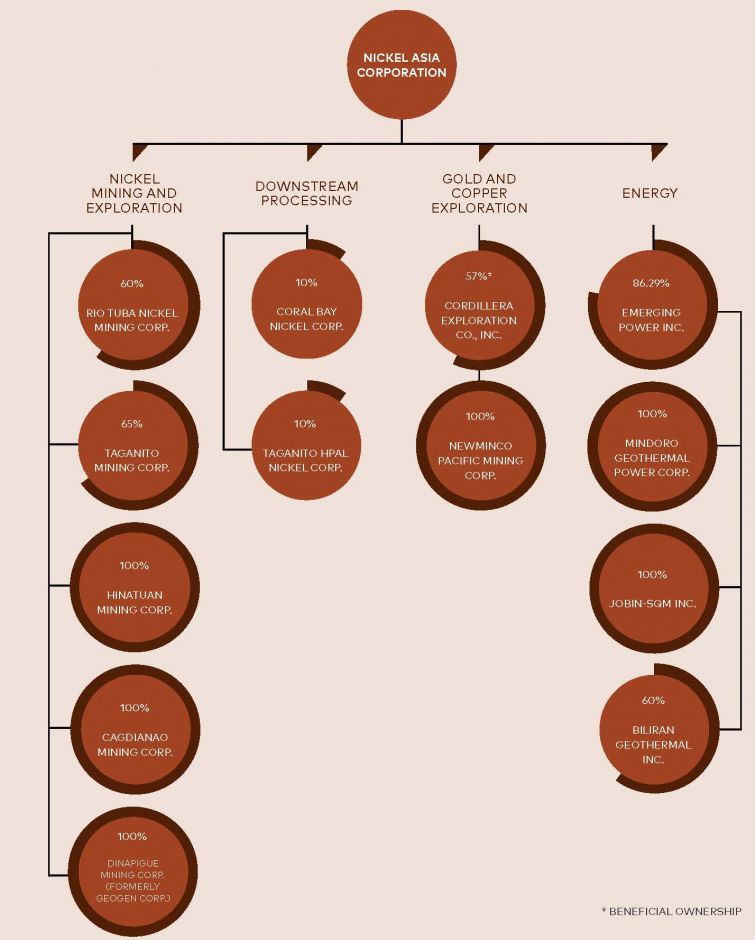

Nickel Asia Corporation is the Philippines' largest producer of lateritic ore, and one of the largest in the world.

The Company exports saprolite and limonite ore to customers in Japan, China and Australia.

The Company owns 4 operating mines located in the southern half of the country.

NIKL owns 86% of EPI, which has solar, wind and geothermal services contracts in Subic Bay Freeport and Biliran, Leyte.

Japan's Sumitomo Metal Mining owns nearly one-fifth (1/5).

1. Basic Information:

Nickel Asia Corporation (NIKL)

Sector: Mining and Oil

2. The Company's History:

1977: first operation in Rio Tuba made its first ore shipment to Japan.

July 24, 2008: Nickel Asia Corporation (NIKL) was incorporated with the Securities and Exchange Commission primarily to engage in the business of mining of all kinds of ore, metals and minerals and in the business of generation, transmission, distribution and supply of electricity to cities and other localities.

November 22, 2010: The Company's listing date to PSE

2015: NIKL formalized its entry into the renewable power business through a debt-to-equity conversion and additional equity infusion into Emerging Power. Inc. (EPI)

August 2015: The Company concluded the purchase of 100% interest in Geogen Corporation, which is the claim owner of the Isabela nickel project in Dinapigue, Isabela.

December 2016: NIKL wholly owns Hinatuan Mining Corporation, Cagdianao Mining Corporation; Samar Nickel Mining Resources Corporation; and Geogen Corporation.

<Here's the Company's Stock Data for the past year 2017-2018>

<The Company's Stock Data since 2010 until 2018>

3. Present Stock (2018/10/12)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Manuel B. Zamora, Jr.

Age: 80

Nationality: Filipino

Education:

- Bachelor of Laws degree from the University of the Philippines

- Bachelor of Science from University of the Philippines as well as Associate Degree in Arts.

Net worth: US$ 240 million

Background:

- Chairman and founder of Nickel Asia Corporation

- Chairman of RTN, TMC, CEXCI, THPAL, CBNC and Informatics Holdings Philippines, Inc.

- Director of EPI, CLSA Exchange Capital, Inc., Hinatuan Mining Corporation, and Cagdianao Mining Corporation

- Vice Chairman of the Board of Trustees of St. Luke's Medical Center

- Lawyer and member of the Integrated Bar of the Philippines

- Placed third in the 1961 Bar Examinations

5. News

August 9, 2018

NAC net income rises 1.94% amid challenges

May 28, 2018

Mining firm bullish on nickel prospects

https://business.inquirer.net/251561/mining-firm-bullish-nickel-prospects