Philippine Stock Report #10: Concrete Aggregates Corporation (CA)

Hi Everyone!

Today, we'll be focusing on another company which has been in the industry of Construction, Infrastructure & Allied Services since 1959 which is the Concrete Aggregates Corporation (CA)

CA's parent company is Ortigas & Company Limited Partnership, and its ultimate parent company is OCLP Holdings Incorporated, which are both domiciled in the Philippines.

The Company supplies the construction industry with processed aggregates, ready mix conccrete. bituminous concrete mix, and pre-stressed/pre-cast concrete.

1. Basic Information:

Concrete Aggregates Corporation (CA)

Sector: Construction, Infrastructure & Allied Services

2. The Company's History:

January 16, 1959: Concrete Aggregates Corporation was originally incorporated as Concrete Aggregates, Inc.

1973: Concrete Aggregates Inc. merged with Build-On Aggregates Corporation (BAC) and the resulting entity was named Concrete Aggregates Corporation.

1978: Ortigas & Company, Limited Partnership (OCLP) purchased a controlling interest in CA and took over the management of the company.

1998: Concrete Aggregates Corporation was hit by the economic crisis.

September 14, 1999: The Board of CA approved the total and complete closure of the Engineering and Construction Division of the Company, which were comprised of the RMC, BCM, concrete products and construction groups.

2000: The business development for the next several years devolved and focused on the proper maintenance, repair and rehabilitation of the copany's four (4) crushing plants.

2007: The Board of Directors of the company authorized the conduct of a bidding to select an operator of its Angono quarry for a period of fifteen (15) years.

November 29,2007: The Company's Board of Directors declared that the consortium of Republic Cement Corporation and Lafarge Holdings (Philippines), Inc. (the "Consortium") won the bid for the right to operate the company's Angono quarry.

June 2, 2008: The Company entered into an Operating Agreement with BatongAgono Aggregates Corporation (BAAC) whereby BAAC was granted the right to operate the CA's quarry in Angono, Rizal for fifteen (15) years subject to conditiones indicated in the Operating Agreement as well as the CA's Mineral Production Sharing Agreements (MPSAs) and Environmental Compliance Certificates (ECC)

2013: BAAC changed its name to Lafarge Republic Aggregates, Inc (LRAI)

2015: LRAI once again changed its name to Lafarge Holcim Aggregates, Inc.

<Here's the Company's Stock Data for the past year 2017-2018>

<The Company's Stock Data since 2009 to 2018>

3. Present Stock (2018/10/08)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Jaime E. Ysmael

Age: 58

Nationality: Filipino

Education:

- Bachelor of Science in Business Administration from University of the East

- Master of Business Administration from University of Pennsylvania - The Wharton School

- Master of Arts from University of Pennsylvania - School of Arts and Sciences

Background:

- Chairman & President of Concrete Aggregate Corporation

- Senior Vice President of Ayala Land, Inc.

- Director & Treasurer of Cebu Property Ventures and Development Corporation

- Director of Aurora Properties Inc., First Communities Realty Inc., Alabang Commercial Corp., Ceci Realty Inc., Laguna Phenix Structures Corp., Makati Theatres Inc., North Triangle Depot Commercial Corp., Station Square East Commercial Corp., Anvaya Cove Beach and Nature Club, Inc., Vesta Properties Holdings Inc., Alinet.com, Cebu Insular Hotel Co., Inc., Community Innovations Inc., Enjay Hotels Inc., Laguna Technopark Inc. and Makati Property Ventures Inc.

Conglomerate Map

5. News

There's no recent news on the company

Philippine Stock Report #9: Megawide Construction Corporation (MWIDE)

Hi Everyone!

Since our previous post was about a company from the Construction, Infrastructure & Allied Services Industry, we'll be focusing on another strong player in this Industry which is the Megawide Construction Corporation.

Some of Megawide's biggest projects are from SMDC, City of Dreams Manila, DoubleDragon Plaza, and Urban Deca.

Megawide and in partnership with GMR Infrastructure Ltd. from India is handling the project of construction of Terminal 2 Mactan-Cebu International Airport.

Subsidiaries and affiliates include Altria East Land, Inc., Megawide Land, Inc., Megawatt Clean Energy, Inc., GMR Megawide Cebu Airport Corporation, Globemerchant, Inc., Megawide World Citi Consortium, Inc., MWM, Megawide Cold Logistics, Inc. Megawide Construction (BVI) Corporation, Citicore-Megawide Consortium, Inc., and Megawide-GISPL Construction Joint Venture.

Renewable Energy is also part of their business. They are located at Bataan Solar Farm and at Silay Solar Power Plant.

1. Basic Information:

Megawide Construction Corporation (MWIDE)

Sector: Construction, Infrastructure & Allied Services

2. The Company's History:

1997: Megawide is established as a pure constrtuction firm.

July 28, 2004: MWIDE was incorporated to primarily engage in general construction which involves constructuring, enlarging, repairing, or engaging in any work upon buildings, houses and condominium, roads, plants, bridges, piers, waterworks, railroads and other structures, and to own, use, improve and develop real estate of all kinds.

2007: Megawide secures Triple A license from PCAB. The Company was also awarded its first SM Development Corporation (SMDC) project, its biggest project at the time.

2011: Megawide holds Initial Public Offering and is oversubscribed three times. The Company also builds its Precast Facility in Taytay, Rizal, one of the largest in South East Asia.

February 18, 2011: MWIDE was listed in Philippine Stock Exchange

2012: Citicore- Megawide Consortium Inc. is awarded the PPP for School Infrastructure Project (PSIP) - Phase 1 for the construction of over 7,000 classrooms in Regions 3 and 4A.

2013: Megawide is awarded the PSIP-Phase 2 for the construction of over 2,000 classrooms in Regions 1,2,3 and CAR.

2014: Megawide and partner GMR Infrastructure Ltd. from India was awarded the Mactan-Cebu International Airport (MCIA) PPP project for the expansion and operation of airport facilities for 25 years.

Megawide was also awarded of ISO 9001:2008 and ISO 14001:2004 certifications.

2015: Megawide-WalterMart (MWM) Terminals, Inc. is awarded the Southwest Integrated Transport System (SWITS) PPP project for the construction and operation of terminal facilities for 35 years.

Megawide also entered into a new platform in EPC, the construction of Renewable Energy Power Plants.

<Here's the Company's Stock Data for the past year 2017-2018>

<The Company's Stock Data since 2011 until today 2018>

3. Present Stock (2018/10/04)

For the fiscal year ended, Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Edgar B. Saavedra

Age: 45

Nationality: Filipino

Education: Bachelor's Degree in Engineering in De La Salle University; Special Studies in Foundation Formworks in Germany

Net Worth: US$245 Million

Background:

- Chairman, President, CEO & Chief Operating Officer of Megawide Construction Corp. (Construction & Engineering)

- Director of Altria East Land, Inc., MySpace Properties, Inc., Citicore Power, Inc.

- Principal of Citicore Holdings Investment, Inc.

5. News

Megawide aism to book P24-B contracts this year

http://megawide.com.ph/megawide-aims-to-book-p24-b-contracts-this-year/

New Cebu Airport Terminal to lure 12.5 million passengers

http://megawide.com.ph/new-cebu-airport-terminal-to-lure-12-5-million-passengers/

Megawide GMR consortium wins Clark Airport EPC Contract

http://megawide.com.ph/megawide-gmr-consortium-wins-clark-airport-epc-contract/

Philippine Stock Report #8: Holcim Philippines, Inc. (HLCM)

Hi Everyone!

Today, we'll be focusing on another company from the Construction, Infrastructure & Allied Services which is the Holcim Philippines, Inc. (HLCM)

Member of the LafargeHolcim Group, the world leader in the building materials industry present in 80 countries.

HLCM has cement manufacturing facilities in La Union, Bulacan, Misamis Oriental and Davao.

1. Basic Information:

Holcim Philippines, Inc. (HLCM)

Sector: Construction, Infrastructure & Allied Services

2. The Company's History:

November 12, 1964: Holcim Philippines, Inc. (HLCM) was originally incorporated as Hi-Cement Corporation (HCC).

February 2000: the Securities and Exchange Commission (SEC) approved the merger of HCC, Davao Union Cement Corporation and Bacnotan Cement Corporation, with HCC as the surviving entity. Simultaneously, the SEC approved the change in corporate name to Union Cement Corporation.

November 12, 2002: The Company acquired Alsons Cement Corporation

2005: The Company change its corporate to the present one.

2014: The Company Launched Holcim Skim Coat, Holcim Tile Adhesive and Holcim Waterproofing

<Here's the Company's Stock Data for the past year 2017-2018>

<The Company's Stock Data since 2009 until 2018>

3. Present Stock (2018/10/04)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Tomas I. Alcantara

Age: 72

Nationality: Filipino

Education:

- Bachelor of Science Degree in Economics from the Ateneo de Manila University

- MBA from Columbia University, USA

- Advance Management Program (AMP) of the Harvard Business School

Net Worth: US$190 Million

Background:

- CEO of Alcons Consolidated Resources Inc. since August 2011

- President of Alsons Development and Investment Corporation, Sarangani Agricultural Company Inc., Lima Land Inc., Lima Utilities Corporation, Aldevinco, Alto Power Management Corporation and Manila Economic & Cultural Office (MECO)

- Chairman of Alsons Consolidated Resources Inc., Lima Land Inc., Alsons Development and Investment Corporation, Sarangani Agricultural Inc., Aldevinco and Alto Power Management Corporation, Holcim Philippines, Inc.

- Independent Director of Manila Economic & Cultural Office (MECO), Alsons Cement Corporation, PhilWeb Corporation

- Director of Holcim Philippines, Inc.

CORPORATE STRUCTURE

SHAREHOLDING STRUCTURE

5. News

August 31, 2018

Holcim pledges steady cement supply, innovations for Build, Build, Build

https://www.holcim.ph/holcim-pledges-steady-cement-supply-innovations-build-build-build

July 27, 2018

Holcim Philippines reports Q2 2018 performance

https://www.holcim.ph/holcim-philippines-reports-q2-2018-performance

Profit down 25% in 6 months

https://business.inquirer.net/254606/holcim-profit-25-6-months

Philippine Stock Report #7: Eagle Cement Corporation (EAGLE)

Hi Everyone!

Today, we'll be focusing on Eagle Cement Corporation (EAGLE) from the industry of Construction, Infrastructure & Allied Services.

Main products are cement bags sold under the "Eagle Cement Advance" and "Eagle Cement Exceed" brands. Bulk cement sold under the "Eagle Cement Strongcem" brand.

The Company is the 4th largest player in the Philippine cement industry based on sales volume, with the fastest growing market share among all competitors in the industry.

EAGLE has two wholly-owned subsidiaries namely, South Western Cement Corporation (SWCC) and KB Space Holdings, Inc. (KSHI).

1. Basic Information:

Eagle Cement Corporation (EAGLE)

Sector: Construction, Infrastructure & Allied Services

2. The Company's History:

June 21, 1995: Eagle Cement Corporation (EAGLE) was incorporated and registered with the Securities and Exchange Commission.

2008: The Company's plant in San Ildefonso, Bulacan was established.

2010: The Company started its commercial operations.

May 29, 2017: EAGLE is a fully integrated cement manufacturing company in the Philippines listed in the Philippines Stock Exchange (PSE)

<Here's the Company's Stock Data for the past year 2017-2018>

There is no stock data for Eagle Cement Corporation for the past 10 years since their listing date was May 29, 2017.

3. Present Stock (2018/10/01)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Ramon S. Ang

Nationality: Filipino

Age: 64

Education: Bachelor of Science degree in Mechanical Engineering from Far Eastern University

Net Worth: US$2.5 Billion

Background:

- President and CEO of Top Frontier Investment Holdings, Inc.

- Vice Chairman, President and COO of San Miguel Corporation

- Chairman of Eagle Cement Corporation and Cyber Bay Corporation (PSE: CYBR)

5. News

August 8, 2018

EAGLE posts higher net income in 1H, up 5% to P2.3Bn

https://eaglecement.com.ph/article/eagle-posts-higher-net-income-in-1h-up-5-to-p2-3bn/5

June 21, 2018

EAGLE net income rises to P4.26B in 2017

https://eaglecement.com.ph/article/n-a/5

Philippine Stock Report #6: Chelsea Logistics Holdings Corp. (CLC)

Hi Everyone!

Today, we'll be focusing on Chelsea Logistics Holdings Corp. (CLC) from Transporation Services sector.

Whollly-owns subsidiaries of Udenna Corporation, PNX-Chelsea Shipping Corp., Fortis Tugs Corporation, Michael Inc. (MI), Bunkers Manila, Inc, (BMI), Chelsea Ship Management and Marine Services Corp., Chelsea Marine Manpower Resources, Inc., Chelsea Dockyard Corp.

Owns Phoenix Petroleum Philippies, Inc.

Major clients include Cebu Pacific Air, Marine Fuels Philippines Inc., Petron Corporation, Seaoil Phils., Inc., Batangas Bay Carriers Inc., Unioil Petroleum Philippines Inc., Subic Petroleum Trading and Transport Corp., and Islas Tankers and Seatransport Corp.

http://www.chelsealogistics.ph

1. Basic Information:

Chelsea Logistics Holdings Corp. (CLC)

Sector: Transporation Services

2. The Company's History:

July 17, 2006: Chelsea Shipping Corp. (CSC) was incorporated.

January 1, 2007: The Company commenced its commercial operations. CSC was initially established to serve the requirements of its sister company, Phoenix Petroleum Philippines.

August 26, 2016: Chelsea Logistics Holdings Corp. (CLC) was incorporated and registered with the Securities and Exchange Commission (SEC) as Chelsea Shipping Group Corp. primarily to act as a holding company.

March 27, 2017: CLC acquired all of Udenna Investments B.V.'s (UIBV) outstanding capital stock through a share swap agreement with Udenna Corporation. UIBV owns 80% economic interest and 39.97% of the voting rights in KGLI-NM Holdings, Inc., which holds 39.85% economic interest in and owns 60% of the voting stock in Negros Navigration Co., Inc. (Nenaco). Nenaco, in turn, owns 88.31% of 2GO Group, Inc. (2GO). Hence, CLC has a 28.15% indirect economic interest in 2GO.

March 31, 2017: CLC has 11 tankers, 8 tugboats, 7 RoPax (roll-on, roll-off with passengers and cargo), 4 barges, 3 cargo vessels. 2GO has a seperate fleet of 16 RoPax and 8 cargo vessels.

<Here's the Company's Stock Data for the past year 2017-2018>

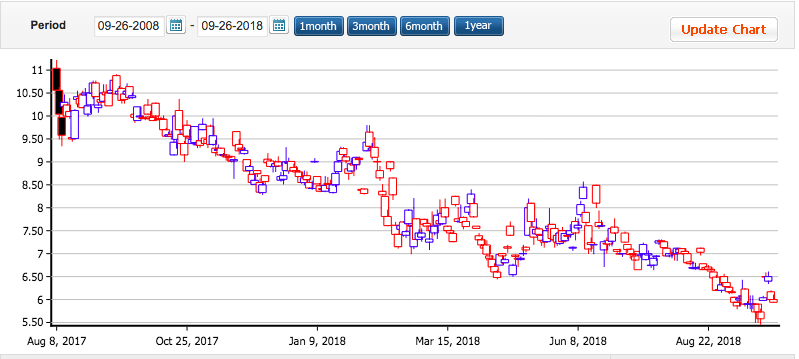

<Stock Data of the Company for the past 10 years 2008-2018>

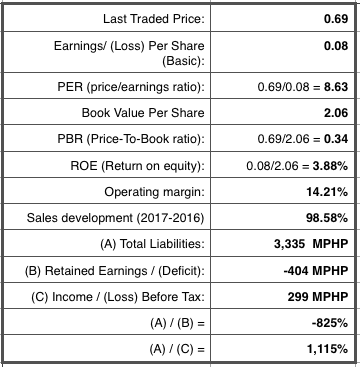

3. Present stock (2018/9/26)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Chairman of the Board

Chairman: Dennis A. Uy

Nationality: Filipino

Age: 43

Education: Business Management at De La Salle University

Background:

- Founder and Chairman of Chelsea Logistics Holdings Corp.

- Chairman and President of Udenna Corporation

- Chairman of Phoenix Philippines Foundation and Udenna Foundation

- Independent Director of Apex Mining Corp.

- Honorary Consul of Kazakhstan of the Philippines

- Currently developing a Casino and Resort in Cebu

Net worth: PHP 430 Million

5. News

May 10, 2018

Chelsea Logistics profit surges in 1st Quarter of 2018

http://www.chelsealogistics.ph/investor-relations/news/chelsea-logistics-profit-surges-in-q1

May 9, 2018

PCC approves megere of Dennis Uy's Udenna with 2GO Shareholder

Philippine Stock Report #5: LBC Express Holdings, Inc. (LBC)

Hi Everyone!

Today, we focus on "LBC Express Holdings, Inc."

LBC is the Philippines' market leader in payments & remittance, documents & mail, parcels & boxes, and cargo & logistics.

6,400 locations, partners, and agents in over 30 countries.

http://www.lbcexpressholdings.com

1. Basic Information

LBC Express Holdings, Inc.

Industry: Transportation Services

2. History of the Company

1950s: LBC Express was initially founded as "Luzon Brokerage Corporation". LBC Air Cargo ("LBC Express") became the 1st Filipino-owned courier company with time sensitve cargo deliviries.

1973: Pioneered 24-hour door-to-door delivery

1985: Started serving the needs of overseas Filipinos, for their cargo requirements bound anywhere in the Philippines.

1990: LBC dominated the cargo, courier and money remittance markets and became known as the "Hari ng Padala"

July 12, 1993: LBC Express Holdings, Inc. (LBC) was incorporated as Federal Chemicals, Inc. to engage in the manufacture of various adhesives, sealants and other chemicals for hardware, construction, do-it-yourself and industrial applications.

December 21, 2001: the Company has been a publicly-listed company and was traded under the ticker symbol "FED" on the Philippine Stock Exchange (PSE)

September 2007: the Company changed its corporate name to Federal Resources Investment Group, Inc. (FED) as well as its primary purpose to that of a holdiing company.

April 23, 2015: the Board of Directors of the Company approved the issuance of 59,101,000 common shares, at 1.00 per share, out of the unissued portion of the Company's authorized capital stock to LBC Development Corporation, subject to acceptable documentation being arrived at, as well as the fulfillment of such conditions agreed upon by the parties, including a mandatory tender offer, where required under relevant laws and regulations.

May 18, 2015: the Company and LBC Development Corporation entered into a Deed of Subscription, whereby LBC Development Corporation, subject to the completion of the mandatory tender offer, subscribed to 59,101,000 common shares out of the unissed authorized capital stock of the Company or 59.10% of the authorized capital stock of the Company. The consideration for the subscribed shares was 59,101,000 or 1.00 per share.

July 2015: LBC Development Corporation (LBCDC) completed its tender offer to FED's shareholders and became the owner of 59.1% of the Company.

September 24, 2015: the Company purchased from LBC Development Corporation a total of 1,041,180,493 shares of stock in LBC Express, Inc. for an aggregate purchase price of 1,384,670,966.

October 2015: LBCDC acquired more shares and increased its equity interest in FED to 84.6%

October 12, 2015: SEC approved FED's application for the change in corporate name to the present one. The Company however, maintained its primary purpose of being a holding company.

<The Company's Stock Data for the past year 2017-2018>

<Stock Data of the Company for the past 10 years 2008-2018>

3. Present stock (2018/9/20)

For the fiscal year ended: Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Board of Director/s

Chairman: Miguel Angel A. Camahort

Nationality: Filipino

Age: 55

Education: Bachelor of Science in Business Administration at College of Notre Dame Of Maryland

Background:

- October 26, 2015 - Present : Chairman of the Board, Chief Execuive Officer, and President at LBC Express Holdings, Inc.

- President and CEO at Federal Resources Investment Group, Inc.

- Senior Vice President of 2GO Group, Inc.

- COO of 2GO Solutions

5. News

August 16, 2018

LBC Express buys majority stake in Malaysian affiliate

https://www.manilatimes.net/lbc-express-buys-majority-stake-in-malaysian-affiliate/430824/

LBC acquires courier unit in Malaysia

http://www.bworldonline.com/lbc-acquires-courier-unit-in-malaysia/

July 10, 2018

LBC Express is halfway through its P100M, 80-branch expansion in 2018

http://www.pna.gov.ph/articles/1040897

Philippine Stock Report #4: Waterfront Philippines, Inc. (WPI)

Hi Everyone!

Today, we focus on "Waterfront Philippines, Inc."

Subsidiaries:

Waterfront Cebu City Casino Hotel Incorporated (WCCCHI)

Waterfront Mactan Casino Hotel Incorporated

Waterfront Promotion Ltd. (WPL)

Waterfront Insular Hotel Davao (WIHD)

Waterfront Entertainment Corporation (WEC)

Waterfront Management Corporation

Waterfront Food Concepts, Inc. (WFC)

Club Waterfront International Limited, Inc. (CWIL)

Waterfront Wellness Group, Inc.

Acesite Phils, Hotel Corp, (APHC)

40% of Mayo Bonanza, Inc. (MAYO)

http://www.waterfronthotels.com.ph

1. Basic Information

Waterfront Philippines, Inc. (WPI)

Hotel & Leisure

2. History of Company

September 23, 1994: Waterfront Philippines, Inc. (WPI) was registered with the Securities and Exchange Commission as an investment holding company for hotel, leisure, and tourism business.

March 23, 1995: WPI acquired Waterfront Promotion Ltd., (WPL) from Waterfront Amusemeny & Gaming Limited (WAGL) and became its wholly owned subsidiary.

<Here's the company's stock data for the past year 2017-2018>

<Company's stock data for the past ten years 2008-2018>

3. Present stock (2018/9/18)

For the fiscal year ended : Dec. 31, 2017

Currency: Philippine Pesos (PHP)

4. Board of Director/s

Chairman: Renato B. Magadia

Nationality: Filipino

Age: 80

Education: Bachelor of Science in Business Administration at University of the Philippines

Background:

Non Executive Director at Philippine Estates Corporation

Chairman at Lancashie Realty Holding Corporation

1998- Present : Chairman of the Board & President at Metro Alliance Holdings & Equities Corp.

2004- Present: Vice Chairman at Acesite (Phils.) Hotel Corporation

2005- Present: Chairman at Waterfront Philippines, Inc.

5. News

No current news on Waterfront Philippines Inc.